Florida uses the federally run health marketplace (exchange), so individuals and families who need to buy their own health coverage use HealthCare.gov to enroll. The marketplace is used by individuals and families who don't have an option of coverage from an employer or Medicare.

Individual/family health plans are purchased by people who are self-employed, people who have retired prior to age 65 and need to buy their own coverage until they become eligible for Medicare, and by people employed by small businesses that don't provide health benefits. The marketplace is also the only place Florida residents can get income-based financial assistance with their individual major medical health coverage.

Read our overview of the Florida health insurance marketplace – including news updates and exchange history.

For 2022 health coverage in Florida, open enrollment ran from November 1, 2021 through January 15, 2022. Outside of the annual open enrollment period, Floridians will need a qualifying event to enroll.

During the open enrollment period for 2021 coverage, 2,120,350 people enrolled in individual market plans through the Florida health insurance marketplace. This was a record high, and the first time that Florida's marketplace enrollment had surpassed 2 million people.

During the first 2.5 months of the COVID/American Rescue Plan enrollment window in 2021, another 264,088 people enrolled in plans through Florida's exchange — well over double the normal pace of enrollment at that time of year.

Eleven insurers offer coverage for 2022 in Florida's exchange. Aetna-CVS is joining the ten existing insurers:

- Aetna-CVS/Coventry (new for 2022)

- AvMed

- Blue Cross Blue Shield of Florida (Florida Blue)

- Bright Health Insurance Company

- Cigna

- Florida Health Care Plan Inc

- Health First Health Plans

- Molina

- Oscar Health

- Florida Blue HMO (Health Options)

- Ambetter (Celtic)

AvMed joined the exchange for the first time in 2021, after only offering plans outside the exchange prior to that. Insurer participation in Florida's exchange also grew for 2020, with Bright Health joining the marketplace, and Cigna rejoining in some areas after exiting the exchange at the end of 2015.

For 2021, Cigna expanded its coverage area again, adding Leon, Lake, Seminole, Orange, Osceola, Broward, Indian River, Martin, and St. Lucie counties to its Florida service area.

For individual-market plans sold in Florida's exchange, the average proposed rate changes for 2022 range from a 7% decrease to a 9% increase.

For 2021, average premiums increased by 3.1% in Florida's individual market. And average rates were flat (ie, a 0% change) for 2020, although there was variation from one insurer to another.

Although the Sunshine State has not embraced the Affordable Care Act from a legislative standpoint, the healthcare reform law has had some positive impacts there.

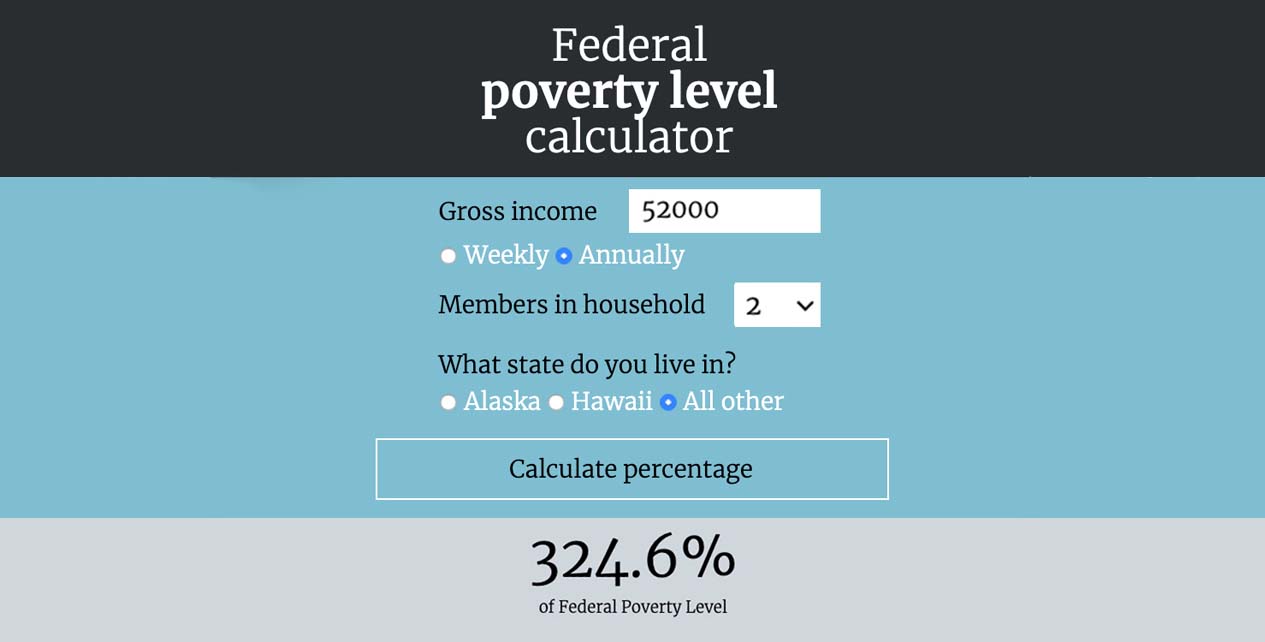

Florida's federally facilitated health insurance exchange has the nation's highest enrollment numbers, all of whom have coverage for the ACA's essential health benefits. And nearly 2 million of them are receiving premium subsidies, which make monthly health insurance premiums much more affordable than they would otherwise be.

According to U.S. Census data, Florida's uninsured rate was 20% in 2013, and had dropped to 12.5% by 2016 (it had risen slightly, to 13%, by 2018, and to 13.2% by 2019, mirroring a nationwide increase in the uninsured rate under the Trump administration).

The national average uninsured rate stood at 9.2% as of 2019, but Florida's rejection of federal funding to expand Medicaid has locked a significant portion of the population out of coverage. If Florida were to expand Medicaid, the uninsured rate would drop substantially.

Although a growing number of states have since opted to expand coverage, there are a dozen – including Florida – that have taken no action to expand Medicaid eligibility to include low-income, non-elderly, non-disabled adults without children.

Florida's decision not to expand Medicaid leaves an estimated 415,000 people in the coverage gap, meaning they do not qualify for Medicaid nor are they eligible for tax subsidies to help them afford private health insurance. According to a Robert Wood Johnson Foundation analysis, more than 1.3 million people in Florida would gain Medicaid coverage if the state were to expand coverage, and the uninsured rate would drop by 30%.

Since 2013, monthly Florida CHIP/Medicaid enrollment has increased by just 10% — versus a nationwide average increase of 38%.

Read more about Medicaid expansion in Florida.

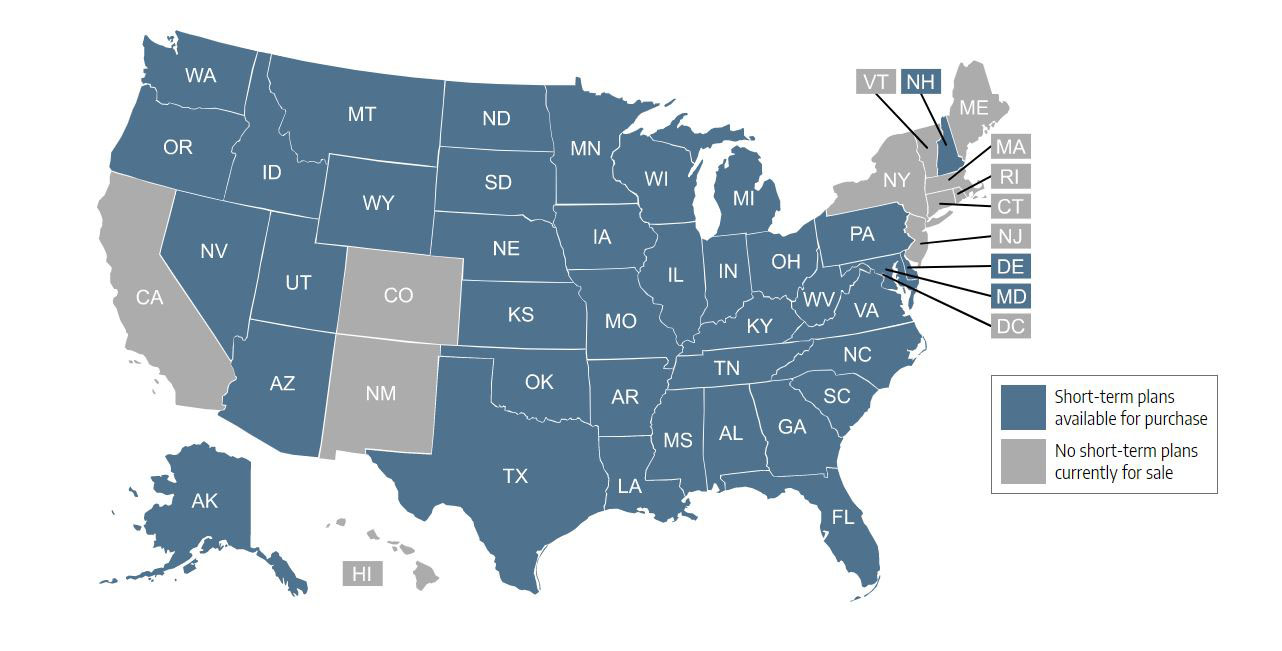

Because Florida does not have state regulations for short-term plans, federal regulations apply in the state. Insurers can offer short-term plans with initial terms up to 364 days and the option to renew for a total duration of up to 36 months.

The Florida Health Insurance Advisory Board recommended that lawmakers add a provision to Florida statute to require stronger disclosure language for short-term plans, and a requirement that consumers sign a statement indicating that they have read the disclosure or had it read to them by a salesperson (the recommendation was approved during a December 2019 FHIAB board meeting, to be forwarded to leaders in the Florida House and Senate. But no action has been taken by lawmakers thus-far).

Read more about short-term health coverage in Florida.

As of July 2021, there were more than 4.7 million Florida residents enrolled in Medicare. Most are eligible because they're at least 65 years of age. But 13% of Florida Medicare beneficiaries are under 65, and are eligible because of a disability that's lasted at least two years, or ALS, or end-stage renal disease.

Learn more about Medicare enrollment in Florida, including the state's rules for Medigap plans.

Learn more about the Medicare open enrollment period for Medicare Advantage and Medicare Part D prescription drug plans.

- Florida Consumer Action Network (FCAN)

- Florida Kid Care

- FloridaHealthFinder.gov

- Federally-funded Navigator organizations in Florida

- University of Florida/Florida Covering Kids & Families

- Urban League of Broward County, Inc.

- Florida Office of Insurance Regulation — Licenses and regulates health insurance companies, brokers, and agents. Provides information and assistance to consumers who have questions or complaints.

- Medicare Rights Center — A nationwide service (call center and website) that can provide advice and information for Medicare beneficiaries.

0 Response to "Affordable Care Act Acacompliant Health Blue Cross Blue Shield Florida"

Post a Comment